UX-Research

for Resursbank

Challenge: Research the behaviour among ages

between 18-30 of how they use different payment methods and how to optimize the features for partial payment. An independent case study through research and finding a better mousetrap for different payment solutions.

Platform: Mobile application.

The goal of this particular project is focused on their mobile application called ”Resurs-app”.

Role

UX-designer, User research, Visual design, Prototyping & Testing

Project time: 8 weeks

(october-november 2024)

Working solo

Company

Sector

School project, Education, Real case

Quick access to prototype

Prototype language is in swedish

Background

Resurs Holding AB is a Swedish financial services company.

Resurs Bank is specialised in consumer credits, unsecured loans and issues credit cards. Learn more about Resursbank.

It’s a competitve space from both traditional banks and creditcard companies.

It’s important to understand the space and able to see what differentiates between the competitors before moving forward, such as Klarna, Qliro and Walley.

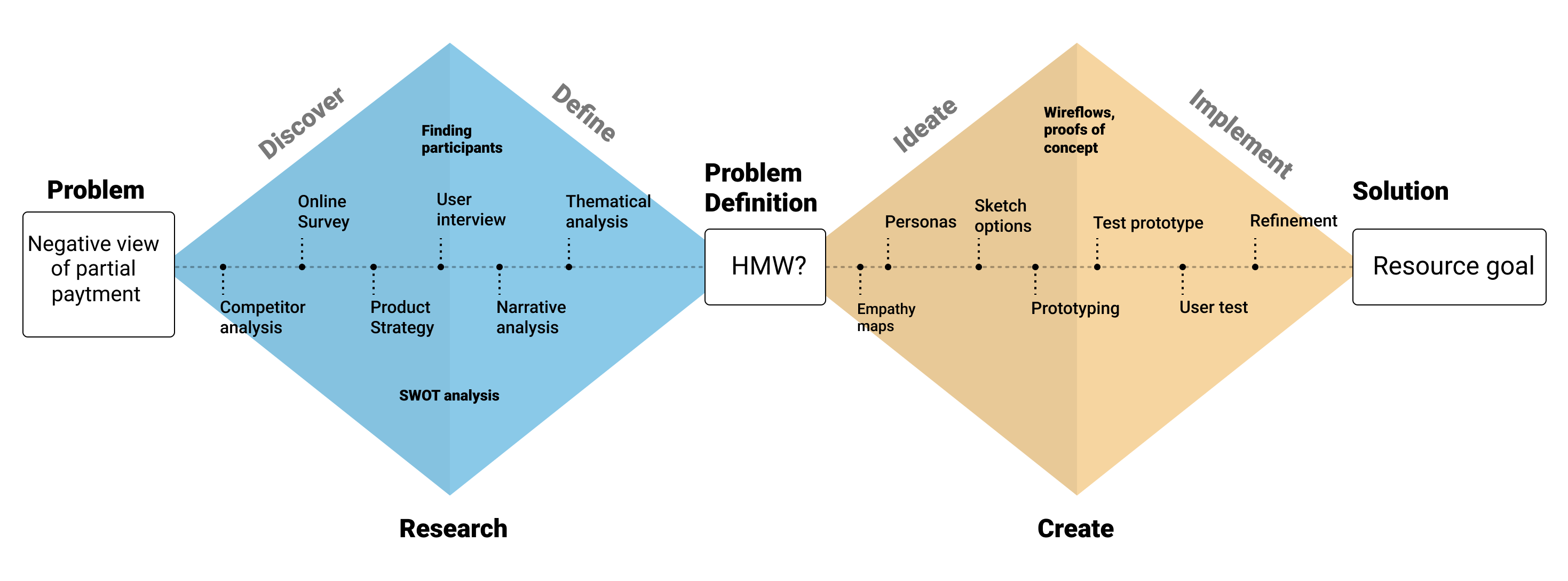

The process

My framework for the designprocess has been mostly based on ”The Double Diamond” but also ”Lean UX” and ”Design Thinking”.

These are the following methods I’ve used and implemented in the designprocess:

- Quantative method

- Qualitative method

- User interview

- Narrativ Analysis

- Thematical analysis

- Empathy maps

- Personas

- User testing

- Guiding tools

- HMW – ”How might we?” questions

- SWOT-analysis

”The Double Diamond” helped me implemented mentioned methods into the framework. This was also a tremendous help for for both scoping and getting overview of the project.

Target group

The participants for this project:

| Age | 23-30 years old |

| Gender | Online survey: 5 men, 24 women User interview: 1 man, 4 women User testing: 1 man, 2 women |

| Occupation | Employed or student |

| Language | Swedish |

| Location | Sweden |

| Participants | Online survey: 29 User interview: 5 User testing: 3 |

Gathering & Insights

The data collection from surveys and interviews shows a negative view and strong discouragement for using partial payment.

The reason for this is mostly because the fear of debts, hidden fees and perception of irresponsibility. It also showed a lack of trust and not feeling safe for using partial payment and at the same time they are expressing financial needs for striving specific goals in life such as getting a drivers license, a car, an apartment etc. Financial struggles was a big factor for getting started to reach their goals and into an independent adulthood.

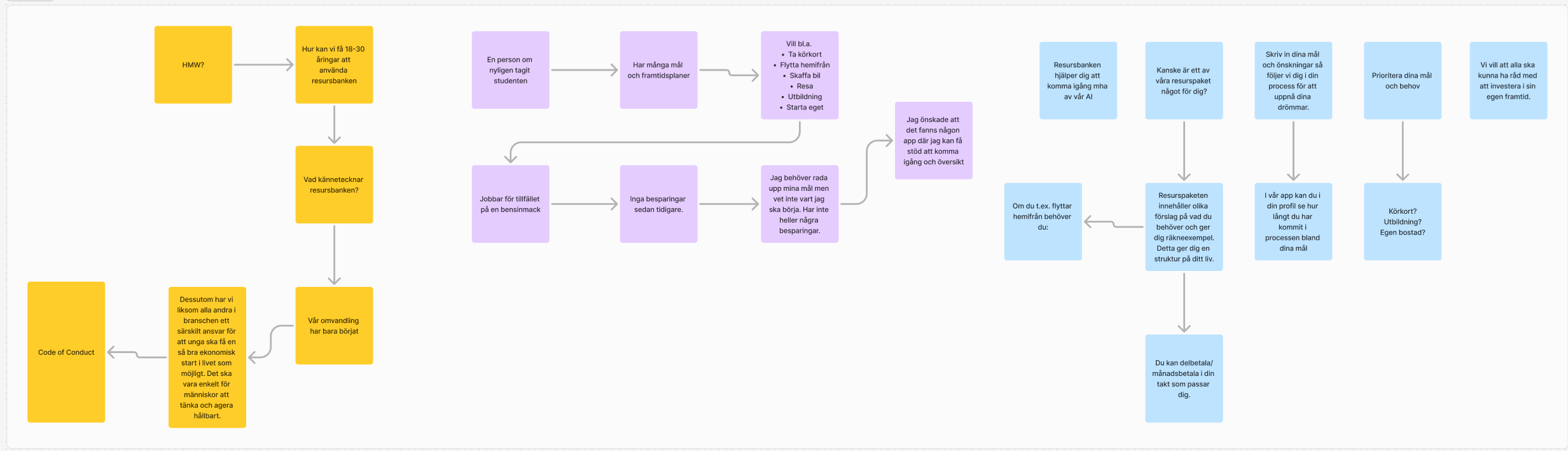

New challenges and pain points where found during the research process which were converted into ”HMW” – questions.

HMW – How Might We;

- Change the view and perception for partial payment?

- Inspire them to choose responsible payment solutions?

- Help them to achieve their life goals and future plans?

- Implement all these features into something smooth, easy and simple way?

I start to iterate and ideate different ideas and came up with new concept so called:

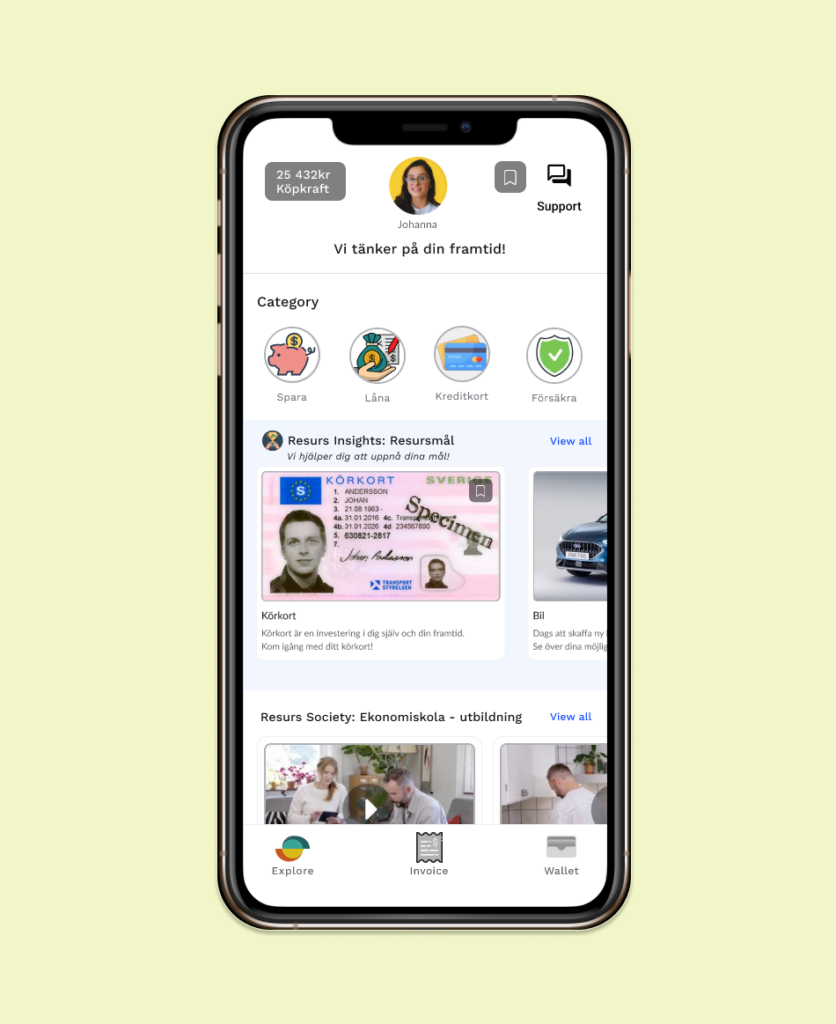

”Resource goals”

The concept:

The target group aged 18-30 is a generation that is trying to find themselves and become independent. Many demands are placed on the individual both from family and friends but also from society. It’s about wanting to be financially self-sufficient and being able to contribute to society. It can be difficult to know where to start, especially if you have limited resources or if your loved ones are not able to provide the financial support. At this age you have several goals and dreams, which most people can relate to.

My approach to this is to find a solution that can inspire young people to invest in themselves and their future, which can be described as life goals. I have then chosen to merge the words: Resource bank and goal into: ”Resource goal”.The mission is to enable everyone to achieve their life goals regardless of their financial situation.

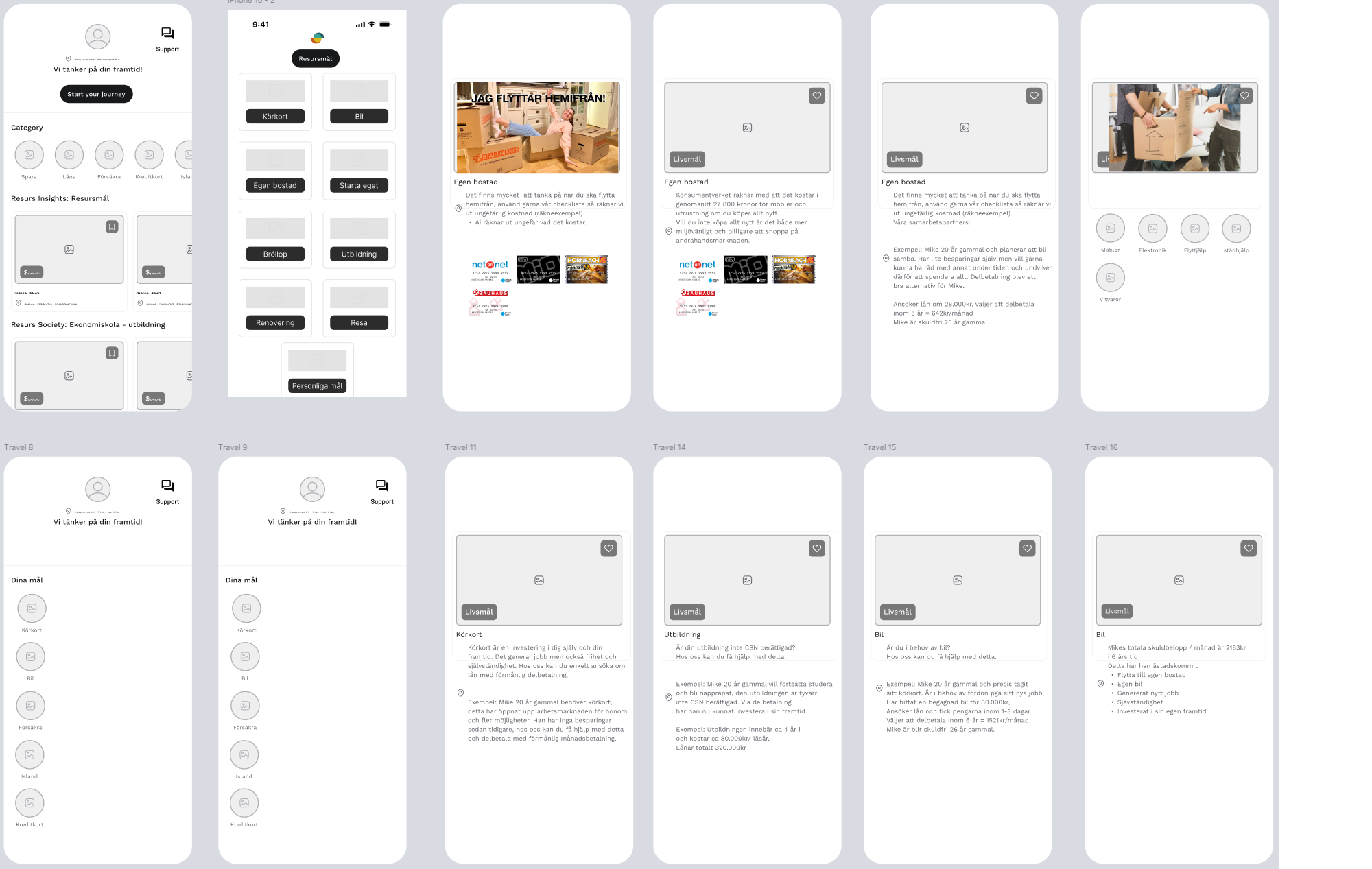

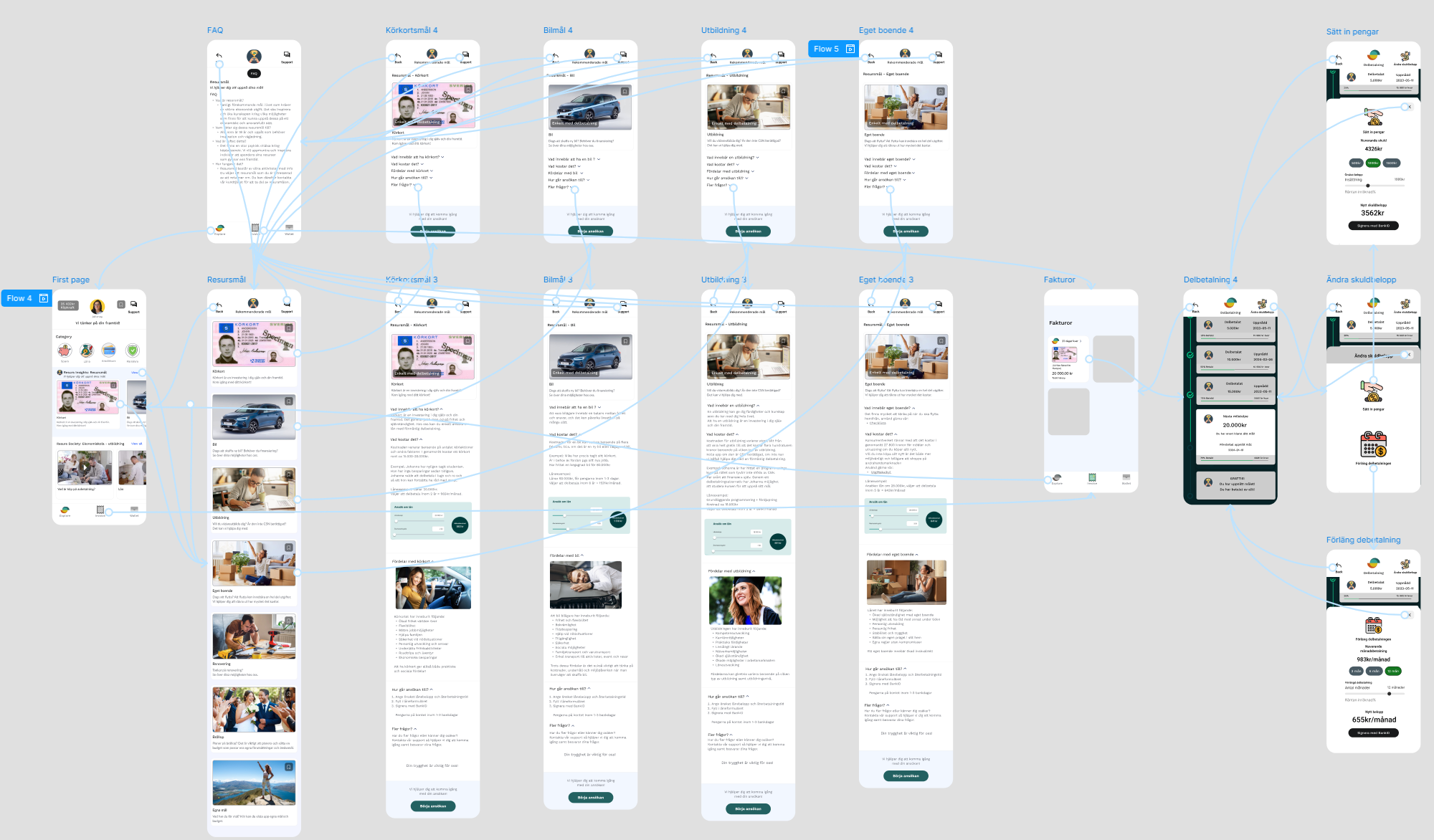

Wire-frame & Prototype

During these phases has mostly been focus on making a proof of concept. Therefore creating a strong content has been the priority rather than visual design. The features during the wire-frame process was first done by sketching out different ideas into chart-flows that eventually developed with time.

Feel free to check out the prototype

Prototype language is in swedish.

Results and takeaways

The study indicates that there is potential to change perceptions of partial payments through a combination of inspiring design and clear information.

The biggest factor was the purpose:

What is partial payment used for?

The concept did somehow indicate a different view for partial payment and it was easy to understand the mission because of the relateble scenarios and goals that was presented. It became clear that one of the deciding factors for choosing partial payment came down to the purpose and the feeling of justification. However there is still a big skepticism for using partial payment even if the concept is well presented. The next question would then be why?

I dont think there is a simple answer for this question because its based on many factors on a personal level. I believe media, hearsays and experiences has the most impact on this topic.

Additionally, introducing something new is often met with skepticism, which is completely normal. Generally, I think it takes time for people to accept new concepts.

A comparison might be a newly opened restaurant with no reviews, people may hesitate to try it until it gains better reviews and a good reputation.

In this case, partial payments require consideration, trust, security, and commitment. Incorporating a “good deal” alongside installment payments, such as interest-free options, insurance, or rewards programs, can also have an impact.

From a user perspective I do understand the skepticism for this concept because it requires time and energy to reflect on one’s future. Other risks was also found that may percieved as being:

- Stressful: Thinking about one’s future can feel overwhelming.

- Unreliable: Do I feel secure using the service?

- Requiring effort: Changing behaviors and learning something new can be challenging.

- Time-consuming: It may feel like an additional burden.

At this stage, it is too early to draw any comprehensive conclusions due to the limited amount of data, however it did touch some ethical points.

Ethical perspectives

Partial payment itself can be perceived as unethical solution because of the risks of getting into debts and financial problems if not following the terms and conditions. On the other hand it can also enable your possibility by enhancing your finance to reach your goals if you do it responsibly.

Partial payment solutions can be seen as a double edge sword where it can both enable or disable your future goals based on responsibility.

This study showed that through a concept with good intentions can inspire people to change their view from something negative into positive, and thats why I think we as UX-designers also have a role of responsibility to understand the impact we can create with our designs.